Know your Business (KYB)

Verify business identities at scale with precision and security

The most precise and secure way to verify the legitimacy of businesses at scale, automate business onboarding with compliance built in.

Top global companies choose Incode for proven fraud protection that drives growth

What is KYB

Frictionless KYB that powers growth and compliance

Whether you’re onboarding vendors, verifying merchants, or managing B2B partners, Incode ensures you’re only working with trusted entities.

Our AI-driven, fully automated platform replaces manual reviews, accelerates onboarding, and ensures compliance across international markets.

Remove manual Proof of Address reviews with automated checks that keep onboarding fast and seamless.

Run watchlists and sanction checks in seconds with smart document extraction and automated analysis.

Eliminate redundant systems and reduce friction by verifying business and Ultimate Beneficial Owners (UBOs) in one platform.

Incode’s leading, AI-first solution approves more legitimate customers to drive incremental revenue.

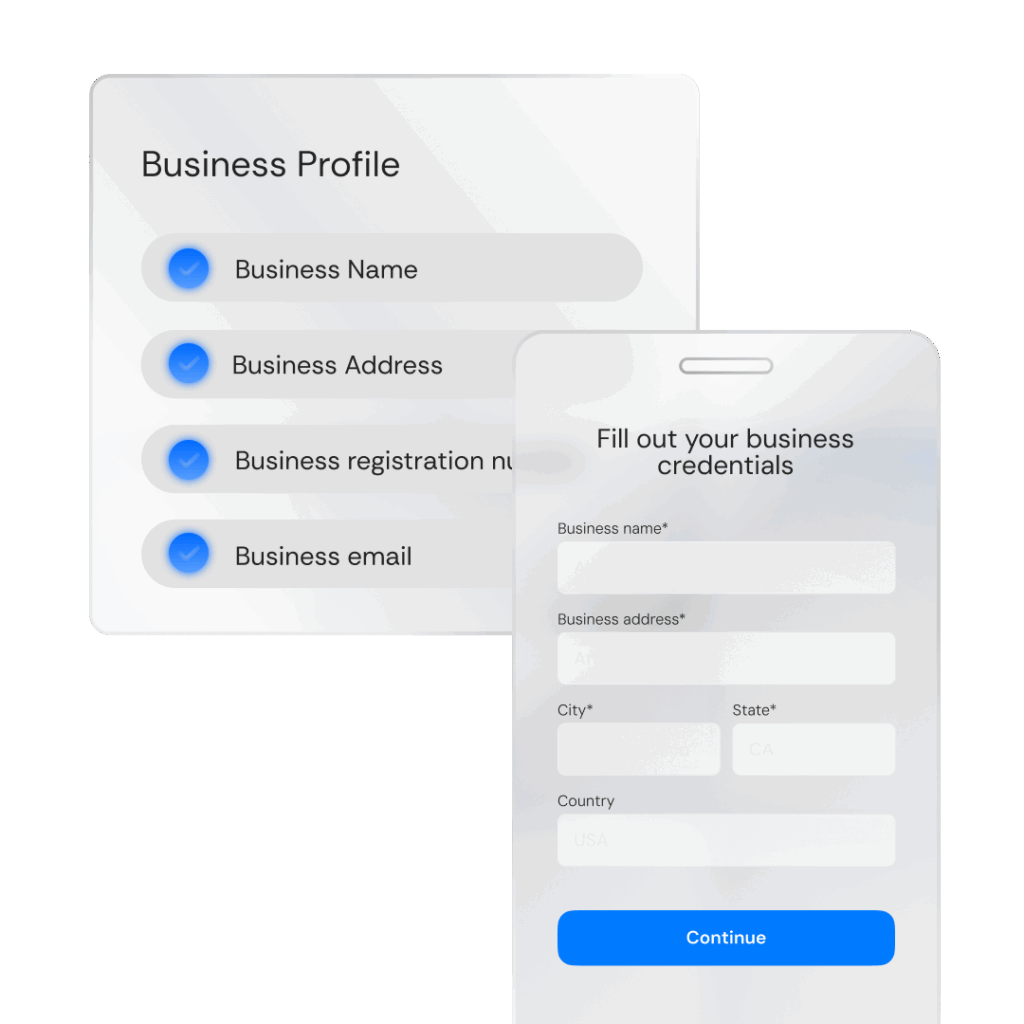

Incode KYB solution

Proactive risk mitigation

Stop fraudulent accounts, cut costs, and boost business growth with our comprehensive KYB verification.

Check tax ID numbers

Validate Tax Identification Numbers (TINs) and Employer Identification Numbers (EINs), including alternative name possibilities.

Screen watchlists

Check against government-sanctioned watchlists, including the U.S. Office of Foreign Assets Control (OFAC).

Match people and UBOs

Identify Ultimate Beneficial Owners (UBOs) and understand which people are associated with each business.

Identify shell companies

Flag potential shell companies by cross-referencing against known lists, identifying suspicious registrations, and uncovering hidden beneficial ownership.

Flag inconsistent information

Automatically cross-check information for discrepancies in names, addresses, dates, or other key identifiers.

Check for news or adverse media

Scour news sources, regulatory databases, and sanction lists for negative information associated with a business entity.

Check tax ID numbers

Validate Tax Identification Numbers (TINs) and Employer Identification Numbers (EINs), including alternative name possibilities.

Screen watchlists

Check against government-sanctioned watchlists, including the U.S. Office of Foreign Assets Control (OFAC).

Match people and UBOs

Identify Ultimate Beneficial Owners (UBOs) and understand which people are associated with each business.

Identify shell companies

Flag potential shell companies by cross-referencing against known lists, identifying suspicious registrations, and uncovering hidden beneficial ownership.

Flag inconsistent information

Automatically cross-check information for discrepancies in names, addresses, dates, or other key identifiers.

Check for news or adverse media

Scour news sources, regulatory databases, and sanction lists for negative information associated with a business entity.

Check business legitimacy in an instant

Automate and accelerate the verification

of potential partners with Incode’s KYB solution.

Incode KYB features

Empower secure and

compliant growth across

industries.

From traditional banking to crypto, our KYB solution reviews UBOs and business entities in seconds, reducing the

risk of fraud.

Marketplaces

Marketplaces

Ensure seller legitimacy

Boost marketplace integrity and reduce risk by verifying businesses operating on your platform.

Safeguard buyer transactions

Mitigate risks for buyers by verifying businesses before transactions are completed.

Online banking

Online banking

Streamline account opening

Accelerate account creation and ensure compliance with KYB checks, with the ability to step up to UBO verification.

Proactive risk monitoring

Continuously screen business accounts for changes in risk profile or suspicious activity.

Online payments

Online payments

Verify merchant identities

Reduce chargebacks and fraud by confirming the legitimacy of merchant businesses.

Transaction monitoring

Analyze transactions in real time to detect and prevent fraudulent activity linked to business accounts.

Crypto services

Crypto services

Comply with local and global regulations

Meet evolving Know Your Customer (KYC)/Anti-Money Laundering (AML) requirements for crypto by verifying business entities.

Combat financial crime

Detect suspicious business accounts and transactions to reduce fraud and money laundering risks.

Business benefits

Reduce fraud, increase business growth

How Incode KYB tackles your biggest verification challenges

Unlock global reach

Expand into new markets by verifying businesses instantly and without

manual processes.

Cover 100% of IRS-registered US businesses plus 190+ countries and

territories worldwide.

Stay compliant

Meet compliance requirements with fast, efficient, fully automated KYB and KYC database checks.

Combine with our Non-Doc Verification of UBOs to verify businesses and their high-level employees.

Streamline your business operations

Speed up onboarding by eliminating costly 30-minute manual reviews. Real-time KYB verification accelerates conversion and reduces lost revenue.

Remove manual bias and error risk by automating analysis, reducing subjectivity, and ensuring consistent, accurate decisions.

Simplify operations by centralizing data collection and screening in one platform, cutting vendor fragmentation and complexity.

Deploy fast

Get up and running quickly with Incode’s flexible API and developer-friendly documentation.

Our dedicated support team streamlines implementation, minimizing the time and resources needed to deploy powerful business verification.

Leading global enterprises choose Incode

Enterprise-grade security and compliance

Resources

Latest resources on KYB

Get in touch

Start verifying businesses in seconds

Say goodbye to manual UBO reviews with Incode’s automated, friction-free KYB solution.

Contact Us